Introduction

Medical coding goes beyond just slapping numbers on diagnoses and procedures. It’s the vital language that communicates to payers what care was given and why it was necessary. When coding is off, the consequences extend far beyond just lost revenue—it can lead to compliance issues, delays in patient care, and even legal troubles. For healthcare providers, getting coding right is crucial for keeping claims clean, ensuring patient satisfaction, and maintaining compliance.

Why Coding Accuracy Matters

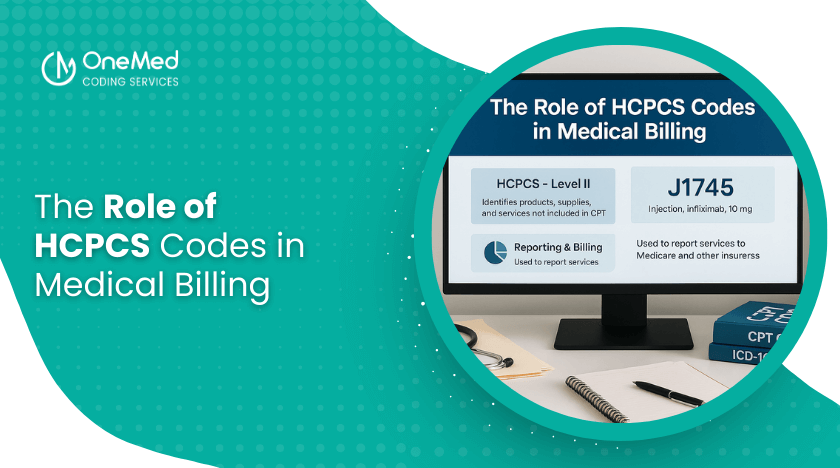

In the revenue cycle, coding serves as the bridge between clinical documentation and financial reimbursement. Each ICD-10, CPT, or HCPCS code needs to accurately reflect the patient’s condition and the services provided by the healthcare professional. If the coding is incorrect, it disrupts this connection, resulting in:

- Denied or delayed claims

- Compliance issues

- Inaccurate patient records

- Higher administrative costs

In simple terms, accurate coding is essential for both financial stability and quality patient care.

Common Causes of Incorrect Coding

1. Incomplete Documentation

When providers don’t capture details like laterality, severity, or treatment type, coders might resort to using generic or incomplete codes. This not only jeopardizes reimbursement but also distorts the clinical narrative.

2. Upcoding and Downcoding

Upcoding: Using a higher-level code than what was actually performed.

Downcoding: Choosing a lower-level code out of caution.

Both practices can trigger audits from payers. Upcoding is seen as fraudulent, while downcoding can mean lost revenue.

3. Lack of Training or Updates

Coding guidelines evolve every year. Without continuous education, coders might miss important updates or specific payer requirements, which increases the likelihood of mistakes.

4. Copy-Paste Errors in EHRs

Electronic health records make it easy to reuse previous codes. However, copying old codes without checking their accuracy can lead to repeated mistakes across multiple patient encounters.

How Incorrect Coding Leads to Claim Denials

One of the most immediate fallout from incorrect coding is denied claims. Payers take a close look at claims to make sure the codes match up with medical necessity and policy guidelines. Here are some common reasons for denial:

- Mismatched codes: When the diagnosis doesn’t support the procedure that’s being billed.

- Invalid or outdated codes: Using codes that are no longer valid.

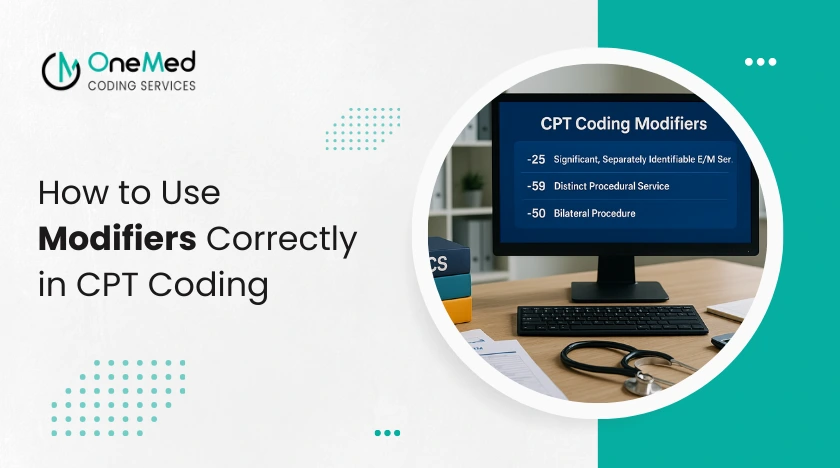

- Missing modifiers: Not including the right modifiers for certain procedures.

- Duplicate billing: Accidentally coding the same service more than once.

Each denial means extra work, resubmission, and often a few follow-up calls—wasting precious time and resources for practices.

Compliance Risks of Incorrect Coding

But incorrect coding isn’t just about denied claims; it also brings along some serious compliance risks.

- Fraud and Abuse Investigations: If upcoding or incorrect billing patterns keep popping up, they might be flagged as fraud.

- HIPAA Violations: Misrepresented codes can mess with data accuracy, which is a crucial compliance requirement.

- Audit Penalties: Payers and government agencies could hit you with fines or demand repayment if they find coding errors.

- Damage to Reputation: Compliance issues can tarnish a provider’s reputation with both patients and payers.

Financial and Operational Impact

The cost of incorrect coding is high:

- Revenue lost from denied or underpaid claims

- Longer days in accounts receivable (AR)

- Increased workload for billing teams

- Slower cash flow for providers

Research indicates that even a tiny fraction of coding errors can cost practices thousands of dollars each month.

Best Practices to Prevent Errors

- Enhance Documentation: Train providers to capture specific details that bolster coding accuracy.

- Invest in Coder Education: Regular training ensures coders stay informed about annual changes and payer guidelines.

- Leverage Technology: Coding software and EHR prompts can highlight missing information before submission.

- Perform Regular Audits: Internal or external audits can help identify mistakes before they escalate into compliance issues.

- Foster Communication: Promote collaboration among coders, billers, and providers to clarify documentation.

0 Comments